From enlightenme.com

Some borrowers like to shop for a home loan lender the way they shop for a used car. They might kick the tires on a few, find something they can live with and haggle over rate. Unfortunately, this approach doesn’t always work because the relationship you have with your mortgage lender lasts longer than the standard used car-buying transaction. As long as you keep a few key strategies in mind, finding a lender can be easier than buying a used a car.

Set an appointment with a Home Loan Lender

Setting an appointment with any home loan lender seems like the most basic of steps in the mortgage process. In truth, often the basic elements can tell you the most about how your relationship will develop. Test the ease of getting an appointment, as well as the attitude while making it. Unless you’re dealing with someone who can get you 10 percent lower than the going interest rate, it isn’t worth working with a mortgage lender who seems annoyed by your very request for an appointment.

The availability of your potential home loan lender is another factor you should not overlook. Even though you may have plenty of time to close your mortgage, you don’t want to devote a lot of time to someone booked solid over the next two months. If the representative doesn’t have a loan program to fit your needs at the appointment, you’ll find yourself two months behind schedule and still at square one.

Involve all the decision makers

Even if you handle all the financial details for your family, make sure to involve your spouse in the initial consultations. Just because you know the budget like the back of your hand does not mean your husband or wife will never interact with your home loan lender. In fact, you may find that your spouse can handle the communication with your mortgage representative while you work on collecting the documentation the lender needs.

Search for the right fit

Extensive mortgage knowledge is critical for any home loan lender, but not the only thing for you to consider. How does the mortgage lender make you feel during your interactions? If he or she acts annoyed when you have questions or talks down to you, this is not someone you want to handle your loan. Instead, look for someone with the right balance of personality, experience and knowledge.

Negotiate the terms

A good home loan lender will understand that one mortgage loan does not always fit all. Be honest about your finances and speak up if your lender offers you a deal you cannot afford. In most cases, there are ways to modify many of the critical mortgage elements in such a way that both you and the lender can walk away pleased about the deal.

Julia Roberts has listed her Hanalei, HI estate with more than 200 feet of beachfront for $29.85 million, Pacific Business News reports.

Julia Roberts has listed her Hanalei, HI estate with more than 200 feet of beachfront for $29.85 million, Pacific Business News reports.

Zachary Quinto has made a logical leap, shifting coasts as much of his work moves east.

Zachary Quinto has made a logical leap, shifting coasts as much of his work moves east.

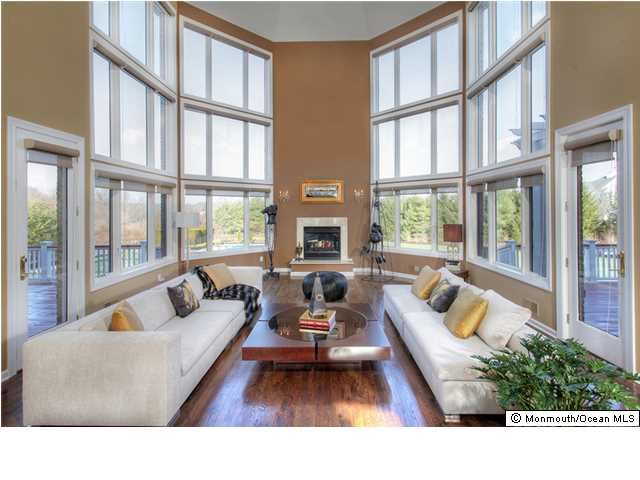

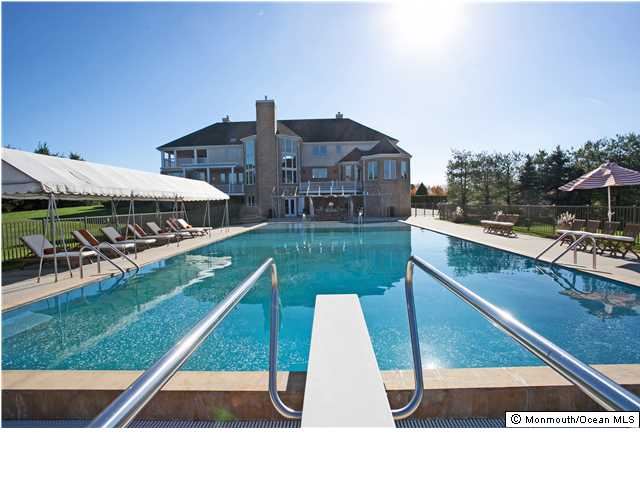

They made her wait, but Queen Latifah has finally welcomed new owners to her New Jersey palace.

They made her wait, but Queen Latifah has finally welcomed new owners to her New Jersey palace.

Jonah Hill, the subwolf of Wall Street, is listing his Soho pad for $3.5 million after trying unsuccessfully to get a bigger moneyball — $3.8 million — for it last summer, Curbed New York reports. He also asked $12,000 to $14,000 a month in rent last fall.

Jonah Hill, the subwolf of Wall Street, is listing his Soho pad for $3.5 million after trying unsuccessfully to get a bigger moneyball — $3.8 million — for it last summer, Curbed New York reports. He also asked $12,000 to $14,000 a month in rent last fall.

Actress Jaime Pressly, who just landed an ongoing gig in the CBS comedy series “Mom,” is selling her Sherman Oaks, CA home for almost $2.2 million.

Actress Jaime Pressly, who just landed an ongoing gig in the CBS comedy series “Mom,” is selling her Sherman Oaks, CA home for almost $2.2 million.