This post was written by Amy Bennett for Decor&Style

Your home is the place that you come back to every evening, somewhere that you can feel safe and where you can just relax with your family. You want to make the most of the space that you have and put your own stamp on the property. One way to do this is by adding color throughout the various rooms, colors which you love and that create the feel that you want. The tough decision may be how to incorporate the colors in a more adventurous way than simply painting one wall a different color. With interior design ever changing, there are many ways in which you can add color with new and exciting ideas.

Your home is the place that you come back to every evening, somewhere that you can feel safe and where you can just relax with your family. You want to make the most of the space that you have and put your own stamp on the property. One way to do this is by adding color throughout the various rooms, colors which you love and that create the feel that you want. The tough decision may be how to incorporate the colors in a more adventurous way than simply painting one wall a different color. With interior design ever changing, there are many ways in which you can add color with new and exciting ideas.

The Kitchen

The heart of the home is the kitchen and it is a great place to add color as it can affect the atmosphere when dining dramatically. Ways in which you can add color within the kitchen include the tiles and splash backs, blinds, and worktops. Tiles and splash backs are an essential part of the kitchen, unless you want to have your walls covered in spurts of food and spillages from cooking.

A block of bright color in the form of a splash back can be extremely striking and can make quite an impression within your kitchen. These can also be accompanied by a colored worktop to create a theme within the room. These can both be great focal points and will always be a conversation starter when you are entertaining.

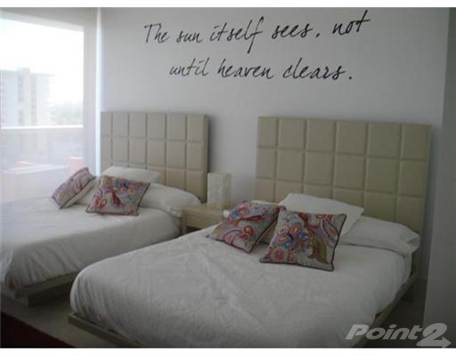

The Bedroom

A trend that has developed within the past few years is the color wall in a bedroom. Usually behind the bed, it can create a sophisticated feel to any bedroom by painting the wall a prominent color or using colorful wallpaper. Try to pick a color you both like if you share a room and one which will create a cozy and relaxing atmosphere you can both enjoy.

You could try an alternative way of adding color into your boudoir by simply painting your room cream and having all of your accessories including the curtains, bedding and lampshades one color. This means that you can change the color scheme whenever you wish with simply replacing the accessories. Every few years it will then seem as though you have redecorated the entire room.

The Playroom

Children love color, and a great place for them to be surrounded by color is in their playroom. How about painting each wall a different bright color, or putting up striped wallpaper which features a variety of shades. A great idea is to use paint which you can wipe clean. Therefore if your little rascals get a bit carried away with their drawing, you can simply clean it off. Creating patterns can open their imagination and help their minds to develop.

The Bathroom

Within the bathroom you can create a great underwater world which can be enjoyed by all the family. You can incorporate shades of blue throughout the room by the accessories or even the bathroom suite if you wanted to make a statement. As most bathrooms are one of the smallest rooms in the house, try not to go overboard as it can become overpowering quite quickly.

Within the bathroom you can create a great underwater world which can be enjoyed by all the family. You can incorporate shades of blue throughout the room by the accessories or even the bathroom suite if you wanted to make a statement. As most bathrooms are one of the smallest rooms in the house, try not to go overboard as it can become overpowering quite quickly.