I consider my porch to be an extension of my home. When putting it together I thought about how I would be spending my time there and outfitted it with those essentials early on. But just like inside our homes, an occasional tweak to your outdoor space can produce dramatic results. Here are five different ways to give yours a subtle but refreshing makeover.

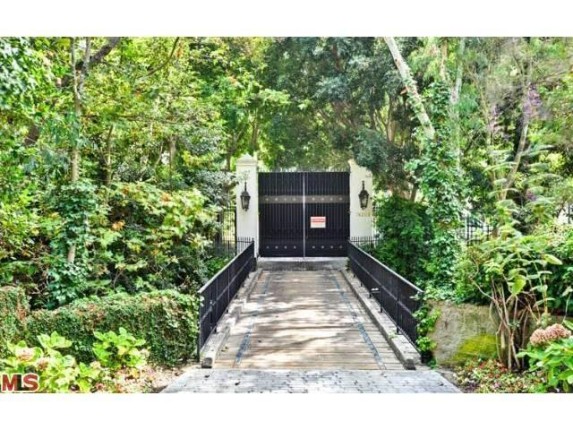

1. Go Green - My porch has always had a few plants on it here or there. Every season I add a new container garden to greet you as you walk up the steps, and I love a good hanging fern to add a touch of southern appeal. This season I changed the vibe up totally by moving the majority of my houseplants to the front porch instead of spreading them throughout my garden. Thanks to a huge collection of plants and one happy ficus tree, I now relax in an outdoor oasis of greenery. (Photos 1 & 2)

2. Think Symmetrically - Many of us are naturally drawn to symmetry. Why? It's generally calming and pleasing to the eye and can make a small space feel bigger. We often incorporate symmetry into our homes, so why not our outdoor living spaces? If you only have one sofa or a porch swing, you can add symmetry by flanking the furniture with potted plants or small end tables. If you have room for multiple chairs or sofas, just try rearranging them for an easy fix. (Photo 3)

2. Think Symmetrically - Many of us are naturally drawn to symmetry. Why? It's generally calming and pleasing to the eye and can make a small space feel bigger. We often incorporate symmetry into our homes, so why not our outdoor living spaces? If you only have one sofa or a porch swing, you can add symmetry by flanking the furniture with potted plants or small end tables. If you have room for multiple chairs or sofas, just try rearranging them for an easy fix. (Photo 3)

2. Think Symmetrically - Many of us are naturally drawn to symmetry. Why? It's generally calming and pleasing to the eye and can make a small space feel bigger. We often incorporate symmetry into our homes, so why not our outdoor living spaces? If you only have one sofa or a porch swing, you can add symmetry by flanking the furniture with potted plants or small end tables. If you have room for multiple chairs or sofas, just try rearranging them for an easy fix. (Photo 3)

2. Think Symmetrically - Many of us are naturally drawn to symmetry. Why? It's generally calming and pleasing to the eye and can make a small space feel bigger. We often incorporate symmetry into our homes, so why not our outdoor living spaces? If you only have one sofa or a porch swing, you can add symmetry by flanking the furniture with potted plants or small end tables. If you have room for multiple chairs or sofas, just try rearranging them for an easy fix. (Photo 3)

3. Go Bright - Everybody knows throwing in a bright pop of color can give you the wow factor you never realized you were missing. You could forgo a permanent fix by just adding color in the form of bright pillows or a rug, but if you're feeling adventurous, consider painting your door or ceiling a bold color. (Photos 4 & 5)

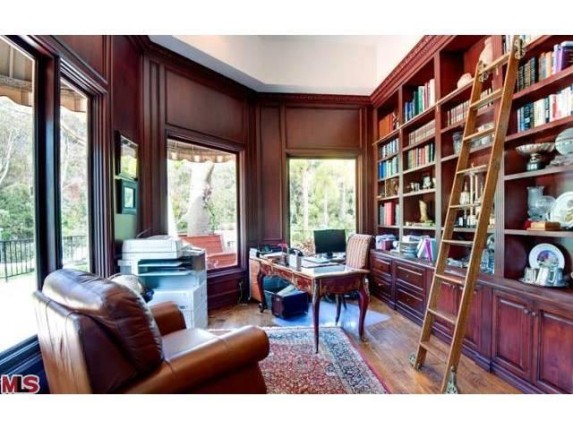

4. Add Layers of Texture - Unlike color, which often makes a bold statement, texture may not be quite as obvious, but can still make a big impact. Texture can add dimension to a space, create harmony between different elements, or serve as a focal point. Consciously adding layered and contrasting textures is a quick way to transform a room, especially outdoors where texture is easy to come by. Maybe you have an old bench that is beyond saving. Why not swap it out for a crocheted hammock or rattan hanging chair? If your porch floors have seen better days, consider adding an outdoor rug. I have a Mad Mat (similar to the one shown in image 8) that served its purpose so well, I decided to leave it in place even after my porch floor was restored. This type of recycled plastic rug adds so much interest, my porch seemed boring without it. You could also switch out your dull plastic plant pots for embellished ceramic pots with funky glazes or stick your current plastic pots inside seagrass baskets. (Photos 6,7 & 8)

5. Let There Be Light - I don't know what it is, but I love lights of all kinds in my outdoor spaces. String lights, lanterns, or a stake light in a potted plant can all be super easy ways to do this. I usually use solar lights which don't tend to be as luminous, so I never feel overwhelmed by the brightness. I love the idea of adding strands of light to each slat of the porch trellis for an over-the-top party vibe (as seen in image 10 above). If you have a bigger budget, consider installing a ceiling fan with a light. If you already have a ceiling or porch light, you could switch to a colored blue or purple bulb for a moody atmosphere. (Photos 9 & 10)

Try incorporating one or two of these ideas to see how it transforms your outdoor space. You might find the end result was the outcome you were looking for (like me), or maybe you're so impressed with your simple update you'll want to try all five.