Friday, July 31, 2015

Tip for a Weed Free Yard - Kill Broadleaf Weeds: Early Season

From the FamilyHandyman.com

A broadleaf weed is any undesirable lawn plant that isn't a grass. Dandelions, plantain, ground ivy (creeping charlie) and ragweed are a few of the most common broadleaf weeds. Before broadleaf weeds start growing in the spring, apply a product called Hi-Yield Turf & Ornamental Weed & Grass Stopper Containing Dimension, which is a preemergent herbicide. It kills weeds before they sprout from seed and even kills some weeds that have just started to grow. Park your broadcast spreader over a tarp or on the driveway (grains may leak out, and a heavy dose of herbicide on the yard can kill even healthy grass). Fill the spreader and distribute the herbicide evenly over your lawn between your first and third mowings in the spring. The company says a single application will last a full 120-day season. It's available at lawn and garden centers (call first to make sure). A 35-lb. bag treats up to 15,000 sq. ft.

A broadleaf weed is any undesirable lawn plant that isn't a grass. Dandelions, plantain, ground ivy (creeping charlie) and ragweed are a few of the most common broadleaf weeds. Before broadleaf weeds start growing in the spring, apply a product called Hi-Yield Turf & Ornamental Weed & Grass Stopper Containing Dimension, which is a preemergent herbicide. It kills weeds before they sprout from seed and even kills some weeds that have just started to grow. Park your broadcast spreader over a tarp or on the driveway (grains may leak out, and a heavy dose of herbicide on the yard can kill even healthy grass). Fill the spreader and distribute the herbicide evenly over your lawn between your first and third mowings in the spring. The company says a single application will last a full 120-day season. It's available at lawn and garden centers (call first to make sure). A 35-lb. bag treats up to 15,000 sq. ft.

Monday, July 27, 2015

Cleaning Tips to Reduce Household Dust

By the DIY experts of The Family Handyman Magazine

Beat and shake area rugs

In most homes, carpet is by far the biggest dust reservoir. It's a huge source of fibers and absorbs dust like a giant sponge. Even the padding underneath holds dust, which goes airborne with each footstep. Some serious allergy sufferers find that the only solution is to tear out wall-to-wall carpet and install hard flooring like wood or tile. Those of us who don't want to take that drastic step have to vacuum regularly. Vacuum pathways and busy areas at least once a week. The dust that gathers under chairs or behind the sofa is less important. It stays put unless it's disturbed by a toddler, a pet or a breeze. Vacuum large area rugs too. But also take them outside three or four times a year for a more thorough cleaning. Drape them over a fence or clothesline and beat them with a broom or tennis racket. A good beating removes much more dust than vacuuming. Take smaller rugs outside for a vigorous shaking every week.

| Shake your rugs Rugs are the biggest dust collectors. Shake them outside three to four times a year. |

BUYING A HOME Debt to Income Ratios - What Are They?

ZILLOW

When you apply for a mortgage, your lender will analyze your debt ratios, which are also known as your debt-to-income ratios, or DTI. Lenders calculate DTIs to ensure you have enough income to comfortably pay for a new mortgage while still being able to pay your other monthly debts.

There are two debt-to-income ratios that your lender will analyze:

Housing ratio or "front-end ratio"

Your lender will add up your anticipated monthly mortgage payment plus other monthly costs of homeownership. Other costs of homeownership could include homeowner association (HOA) fees, property taxes, mortgage insurance and homeowner's insurance. Normally, some of these expenses are included in your monthly mortgage payment. To calculate your housing ratio or front-end ratio, your lender will divide your anticipated mortgage payment and homeownership expenses by the amount of gross monthly income.

Total debt ratio or "back-end ratio"

In addition to calculating your housing ratio, a lender will also analyze your total debt ratio. At this time your other installment and revolving debts will be analyzed and added together. Installment and revolving debts will appear on your credit report. These payments are expenses like minimum monthly credit card payments, student loan payments, alimony, child support, car payments, etc. Your lender will add up all your monthly installment and revolving debts in addition to your estimated monthly mortgage payment and housing expenses and divide that number by your monthly gross income.

Debt-to-income limits

Generally, your front-end and back-end debt ratios should be 28 percent and 36 percent or lower.

- FHA limits are currently 31/43, though these can be higher with justification from the lender.

- VA limits are only calculated with one DTI of 41.

- USDA limits are 29/41.

Some lenders may be able to qualify you with a much higher back-end ratio by getting you approved for a non-conforming loan. A non-conforming loan does not conform to purchasing guidelines set by Fannie Mae and Freddie Mac. These purchasing guidelines usually have to do with standards or limitations on credit scores, LTVs and DTI ratios. Generally non-conforming loans are considered riskier, and a borrower typically has to pay more than they would for a conforming loan.

Saturday, July 25, 2015

Isabella Rossellini Snags a (Relatively) Tiny Home in Manhattan

BY MELISSA ALLISON

ZILLOW

Her main home is still on Long Island, so this 789-square-foot place appears to be the actress’ pied-a-terre.

Actress Isabella Rossellini already has a home on Long Island, but she just got a deal on a one-bedroom apartment in a high-rise on Manhattan’s Upper West Side. The 789-square-foot pad was listed at $1.32 million; Rossellini paid $1.275 million.

Actress Isabella Rossellini already has a home on Long Island, but she just got a deal on a one-bedroom apartment in a high-rise on Manhattan’s Upper West Side. The 789-square-foot pad was listed at $1.32 million; Rossellini paid $1.275 million.

ZILLOW

Her main home is still on Long Island, so this 789-square-foot place appears to be the actress’ pied-a-terre.

Actress Isabella Rossellini already has a home on Long Island, but she just got a deal on a one-bedroom apartment in a high-rise on Manhattan’s Upper West Side. The 789-square-foot pad was listed at $1.32 million; Rossellini paid $1.275 million.

Actress Isabella Rossellini already has a home on Long Island, but she just got a deal on a one-bedroom apartment in a high-rise on Manhattan’s Upper West Side. The 789-square-foot pad was listed at $1.32 million; Rossellini paid $1.275 million.

The apartment is in a 35-floor building with a 60-foot lap pool, a fitness center, yoga studio and saunas. It features hardwood floors, floor-to-ceiling windows, a large terrace and, according to The New York Observer, which broke the story, custom Italian cabinetry.

Rossellini herself is half Italian, the daughter of Italian master filmmaker Roberto Rossellini and Swedish Oscar-winning actress Ingrid Bergman. Isabella celebrated her mother’s centennial at Cannes last month.

Known for roles in “Blue Velvet” and “Big Night,” Rossellini has made 38 short films in the “Green Porno” series on animals’ mating habits, and performs a one-woman show on the subject.

The listing agent for her new home was Yusook (Susan) Kim at Douglas Elliman.

Friday, July 24, 2015

Tip for a Weed Free Yard - Plant Hardy Ground Covers in Shady Areas

From the FamilyHandyman.com

Grass is a sun-loving plant. It typically needs six to eight hours of sunlight daily for good health. While several shade-tolerant species may do OK under trees and in other sheltered spots, it's more likely that you'll end up with weeds, scraggly grass and bare ground. It's much better to plant a shade garden or a shade-tolerant ground cover that in a few years will blanket the area like a green carpet. And you won't have to mow. A local nursery expert will advise you on which plants and ground covers do best in your region.

Grass is a sun-loving plant. It typically needs six to eight hours of sunlight daily for good health. While several shade-tolerant species may do OK under trees and in other sheltered spots, it's more likely that you'll end up with weeds, scraggly grass and bare ground. It's much better to plant a shade garden or a shade-tolerant ground cover that in a few years will blanket the area like a green carpet. And you won't have to mow. A local nursery expert will advise you on which plants and ground covers do best in your region.

Tuesday, July 21, 2015

Denise Richards Lists Home With Living Room Ready to Party

BY MELISSA ALLISON

ZILLOW

The yard boasts two pools with waterfalls, a grotto and a “beach.”

Actress Denise Richards is asking $7.749 million for her mansion in Hidden Hills, CA.

Actress Denise Richards is asking $7.749 million for her mansion in Hidden Hills, CA.

ZILLOW

The yard boasts two pools with waterfalls, a grotto and a “beach.”

Actress Denise Richards is asking $7.749 million for her mansion in Hidden Hills, CA.

Actress Denise Richards is asking $7.749 million for her mansion in Hidden Hills, CA.

The 6-bedroom, 8-bath home features a nightlife-style living room with built-in seating, an onyx fireplace, chandeliers and red velvet accents. It also boasts a wet bar surrounded by glass beads. The dining and powder rooms are similarly decked out, with baroque-style wallpaper, furnishings and light fixtures.

There’s also a gourmet kitchen with a pizza oven, two separate offices and a custom-built dog hotel — for rescued pups, according to the Los Angeles Times, which broke the story.

The 1.1-acre property includes two pools with a waterfall, grotto and “beach” entry.

Richards, who has two daughters with ex-husband Charlie Sheen and a third she adopted, is starring this year in the TV series “Vanity” and the movie “Christmas Switch.”

The listing agents are Joshua Altman and Matt Altman, also known as the Altman Brothers, of Douglas Elliman and Jordan Cohen of Re/Max Olson & Associates.

Monday, July 20, 2015

Cleaning Tips to Reduce Household Dust

By the DIY experts of The Family Handyman Magazine

Capture dust—don't just spread it around.

Feather dusters and dry rags pick up some of the dust they disturb, but most of it just settles elsewhere. Damp rags or disposable cloths that attract and hold dust with an electrostatic charge (like Swiffer or Grab-it) work much better. Cloths that attract dust with oils or waxes also work well but can leave residue on furniture. Use vacuum attachments only on surfaces that are hard to dust with a cloth, such as rough surfaces and intricate woodwork, because the exhaust stream from a vacuum whips up a dust storm.

| Use electrostatic dust rags Use damp rags or disposable electrostatic cloths that attract and hold dust. |

Saturday, July 18, 2015

Check Out Caitlyn Jenner's New Malibu Estate

BY MELISSA ALLISON

ZILLOW

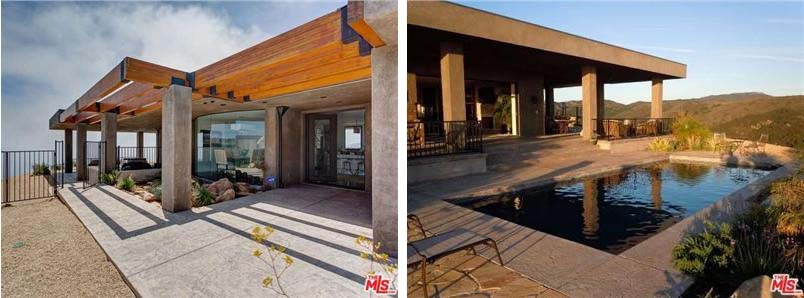

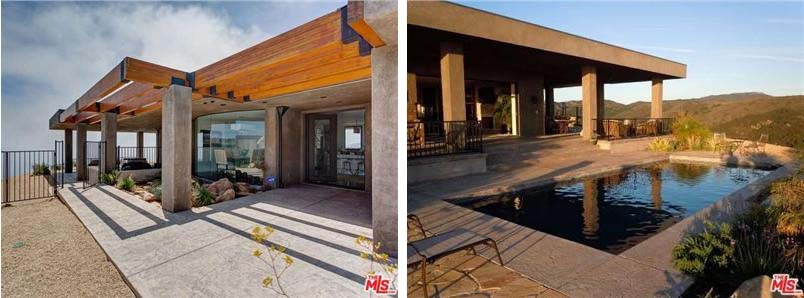

The celebrated Olympian embarks on her new life with 360-degree views of the ocean, mountains and canyons.

ZILLOW

The celebrated Olympian embarks on her new life with 360-degree views of the ocean, mountains and canyons.

The Jenner formerly known as Bruce — now Caitlyn — has taken a page from her daughters and bought her own Southern California pad.

The former Olympian — and former spouse to Kardashian matriarch Kris — dropped more than $3.5 million on an 11-acre spread in Malibu with 360-degree views of the ocean, mountains and canyons, as first reported by Variety.

The 4-bedroom, 4-bath home sounds plenty cozy, with radiant-heated floors, and fireplaces inside and out. There’s a covered patio, swimming pool and spa, and a downstairs area that could be used as a gym, office or guest quarters.

Jenner’s teenage daughters, Kendall and Kylie, have reportedly spent millions in recent months on their own homes in the Los Angeles area.

The listing and buyer’s agent was Brant Didden of 4 Malibu Real Estate

.

Friday, July 17, 2015

Tip for a Weed Free Yard - Healthy Grass Is the Best Weed Preventer

From the FamilyHandyman.com

Lawns that are nutrient-stressed are a breeding ground for weeds, so the best defense is a healthy lawn.

Lawns that are nutrient-stressed are a breeding ground for weeds, so the best defense is a healthy lawn.

Test the soil to see what type and quantity of fertilizer is needed to help your lawn. Proper fertilization improves lawn health, so grass can compete better and crowd out weeds— without a lot of weed killer.

Tuesday, July 14, 2015

Michael Jackson's Neverland on the Market for $100M

BY MELISSA ALLISON

ZILLOW

The orangutans are gone, but the railroad station and 22 structures still stand.

ZILLOW

The orangutans are gone, but the railroad station and 22 structures still stand.

The acreage that was once a fantastical amusement park for the King of Pop is on the market — but without the carnival rides, orangutans and elephant, The Wall Street Journal reports.

The 2,700-acre estate north of Santa Barbara is on sale for $100 million.

Still standing are the railways and grand train station Jackson built, the Journal reports, as well as a floral clock that spells out “Neverland” and a fire department, minus the firefighters.

The property features some 22 structures, including a 12,000-square-foot main house with six bedrooms and attached staff quarters. There are also two- and four-bedroom guesthouses, a swimming pool, basketball court, tennis court and 50-seat movie theater with a private viewing balcony.

Jackson paid $19.5 million for the property in 1987. A real estate investment firm later bought a loan on which he defaulted and put the title into a joint venture with him, the Journal reports.

Suzanne Perkins and Harry Kolb of Sotheby’s International Realty and Jeffrey Hyland of Hilton & Hyland hold the listing.

Photos by Jim Bartsch

Monday, July 13, 2015

Cleaning Tips to Reduce Household Dust

By the DIY experts of The Family Handyman Magazine

Rotate bedding weekly

Your cozy bed is a major dust distributor. The bedding collects skin flakes, sheds its own fibers and sends out a puff of dust every time you roll over. To minimize the fallout, wash sheets and pillowcases weekly. Items that aren't machine washable don't need weekly trips to the dry cleaners—just take blankets and bedspreads outside and shake them. You can spank some of the dust out of pillows, but for a thorough cleaning, wash or dry-clean them. When you change bedding, don't whip up a dust storm. Gently roll up the old sheets and spread out the new ones; even clean bedding sheds fibers.

| Change bed sheets weekly Frequently washed sheets reduce skin flakes, fibers and dust in the air. |

4 ways setting up credit card alerts can save you money

By Jeanine Skowronski • Bankrate.com

High alert

Editor's note: Each week, one of Bankrate's personal finance reporters is reporting on a new way to save and chronicling the savings journey.

Around this time last year, I almost did what was, given my profession as a credit card reporter, unthinkable: I nearly missed a credit card payment.

The culprit was a pesky annual fee that was applied directly to my monthly statement. I caught the balance just in the nick of time, but considering the damage that misstep could have done to my credit score, I wanted to make sure I never ran into a similar problem again.

Luckily, my issuer offers a litany of credit card alerts. These email, text or push notifications (via an issuer's app) are "reason enough to select one credit card over another," says Richard Crone, CEO of Crone Consulting LLC. They can help you monitor spending, minimize fees, reap rewards and spot fraud easily.

Issuers generally list the types of alerts they offer online. You can hop into your credit card account and adjust your settings to receive notice of particular activities or transactions. But don't be afraid to call and ask about offerings before you apply for a specific product.

"Find out what's available and take advantage of it so you can protect yourself and stay financially healthy," says Beverly Harzog, author of "The Debt Escape Plan."

Keep in mind, these alerts are generally free, but your phone's mobile text messaging and Web access charges may apply. Ask your carrier about potential charges before signing up for notifications.

Here are four ways credit card alerts can save you money.

Never miss a payment

Missed payments can be very expensive. For starters, you'll incur a late fee -- typically around $25 to $35, Harzog says. You'll also start accruing interest on purchases that you may have meant to pay off in full.

Plus, missed payments seriously mess up your credit. A first missed payment on a credit card bill can cause a drop of 70 to 90 points on your credit score, depending on your current score, which, in turn, can make future financing more expensive.

Before applying for a new credit card, check your credit for free at myBankrate.

To prevent this from happening, set up a payment due alert. Many issuers let you customize when this alert gets sent, so you can specify how many days' notice you need to get the money in on time. Set up a payment received alert so you know your payment has posted. And, for some extra security, take advantage of a payment past due alert, which will let you know if you have forgotten to make your minimum payment.

If that happens "call your issuer (and) explain what has happened," Harzog says. "If you don't have a history of this, you have a good chance of getting a pass."

Monitor your spending

Some alerts can be "a great money management tool," Crone says, because they build a greater awareness of how much you are spending. Frequent chargers can use a daily or weekly balance alert, for instance, to make sure their bill isn't getting out of control.

Alternately, you might be able to set a spend threshold for yourself and ask your issuer to notify you once your balance goes above that dollar amount. Many issuers have similar alerts built around your credit limit.

This notification can be helpful in maintaining a budget, experts say. It also lets you know "what your (credit) utilization ratio is if you're worried about your (credit) score," Harzog says. (Remember, a good rule of thumb is to keep your credit utilization rate -- how much debt you are carrying versus how much credit has been extended to you -- under at least 30 percent.)

To stay on top of transactions, set up a spending alert. You can customize these notifications, too, so you know when a purchase exceeds a certain dollar amount.

Find fraud fast

Many consumers "set (spending alerts) at zero," Crone says, so they are notified every time a transaction occurs and can easily spot unauthorized charges. There are other notifications that you should take advantage of in order to readily learn when something is amiss.

Any alerts that "relate to patterns of card use can be very important along the lines of protecting yourself against identity theft," says Bruce McClary, vice president of public relations and external affairs with the National Foundation for Credit Counseling.

For instance, you can have an alert sent every time a transaction is made outside of the U.S.or any time a transaction is made without the card present.

"Anytime the card is used to purchase something online or over the phone, an alert is sent quickly," McClary says .

You can also be alerted if a card is used for a cash withdrawal. These credit card cash advances generally carry the costliest interest rates.

If an alert pops up for a transaction you didn't make, call the issuer immediately to dispute the charge. Some issuers may even provide actionable alerts that give you more control over your account.

"If a questionable transaction surfaces, the alert will be sent for you to decline the transaction or accept the transaction," Crone says. Expect these types of alerts to become more popular as issuers compete for the most valuable credit card customers.

Reap your rewards

Many credit cards allow you to earn points, miles or cash back on your purchases, which can subsequently be used to fund a vacation, subsidize a big buy or even score your dream drone.

To help cardholders keep track of their points reserves, many issuers have incorporated alerts into their rewards programs, McClary says. For instance, set up a monthly alert balance or ask to be notified after a certain amount of points is accumulated so you're sure to use your hard-earned rewards.

If you have a revolving 5 percent cash-back credit card, elect to receive a text or email when it comes time to sign up for new categories. Plus, some issuers have alerts you can take advantage of that will let you know when a special deal or discount it is offering is about to expire.

One rule of thumb to remember: Rewards cards are best suited to consumers who never revolve a balance, given they generally have higher annual percentage rates associated with them. (You don't want any of the points you earn to be rendered moot by interest).

Secondly, make sure the alerts you sign up for are ones that you will really use.

If you simply ask your issuer to send you every alert in its arsenal, "you might start treating it as spam and take the alerts less seriously," McClary says. "Drill down the important ones."

Saturday, July 11, 2015

Pharrell Buys Modern Digs Overlooking LA

BY MELISSA ALLISON

ZILLOW

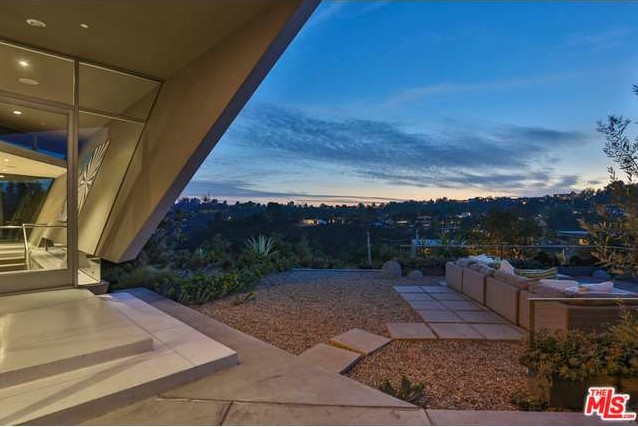

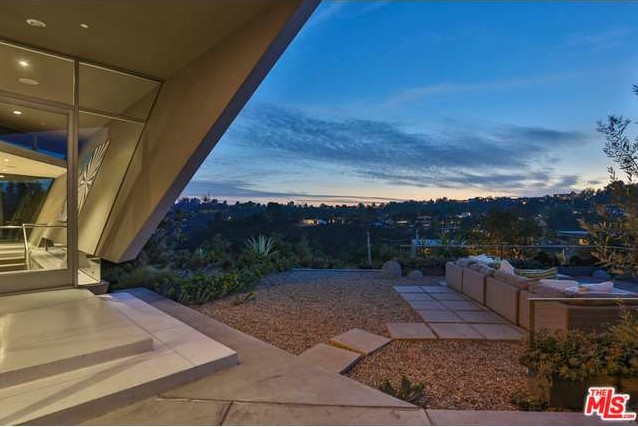

The Jetsons-style living room features a floating fireplace and views of city lights below.

The “Happy” singer recently dropped $7.14 million on a contemporary estate high in the hills above Los Angeles,Variety reports. Its Jetsons-style living room, complete with a floating fireplace, is surrounded by walls of glass with views of an infinity-edge pool and an expanse of city lights below.

The “Happy” singer recently dropped $7.14 million on a contemporary estate high in the hills above Los Angeles,Variety reports. Its Jetsons-style living room, complete with a floating fireplace, is surrounded by walls of glass with views of an infinity-edge pool and an expanse of city lights below.

ZILLOW

The Jetsons-style living room features a floating fireplace and views of city lights below.

Pharrell Williams and his big hat are headed west.

The “Happy” singer recently dropped $7.14 million on a contemporary estate high in the hills above Los Angeles,Variety reports. Its Jetsons-style living room, complete with a floating fireplace, is surrounded by walls of glass with views of an infinity-edge pool and an expanse of city lights below.

The “Happy” singer recently dropped $7.14 million on a contemporary estate high in the hills above Los Angeles,Variety reports. Its Jetsons-style living room, complete with a floating fireplace, is surrounded by walls of glass with views of an infinity-edge pool and an expanse of city lights below.

The compound on 1.5 acres includes 5 bedrooms in the main home, a sixth bedroom in a detached guest house, and an outdoor theater. The listing agent was Justin Mandile of The Agency.

Pharrell also owns homes in Miami and Virginia Beach. He’s listed the Miami condo off and on for the past few years.

Subscribe to:

Comments (Atom)